Hello everyone! Long time, no reads. Been quite the busy month for me in terms of work, sorry ☹️.

Anyways. We are back again! A quick look at what we will be discussing today:

New Tax Appeal Tribunal (Procedure) Rules 2021

The latest salvo in the Tax Wars: Federal Government v. State Governments

Catch 22: Only this time, it’s 50%

The first time I came across the phrase ‘Catch 22’, was in 2017, in a book titled Catch 22 by Joseph Heller. Intriguing phrase but it basically represents a situation where the solution you are exploring may land you right back in the problem you are trying to solve. I’ll explain.

In the book, the story follows a WW2 bomber pilot, named Yossarian. Now, Yossarian was intent on not dying at the war front and was constantly scheming ways of legally escaping duty and he wanted to explore the insanity route. Now, the Army regulations at the time, provided that “a man is considered insane if he willingly continues to fly dangerous combat missions” but “if he makes the necessary formal request to be relieved of such missions, the very act of making the request proves that he is sane and therefore ineligible to be relieved.”

In short, continuously flying into war-torn Europe would make him an “insane man”, but approaching an Army Doc to claim he is insane would place him in the “sane man” category. Consequently, he had to keep flying.

Hence, the reference to “the solution piggybacks into the problem.”

That’s the case in a new addition to the list of regulations guiding tax appeal processes in Nigeria. Very recently, the Minister of Finance issued a new Tax Appeal Tribunal (Procedure) Rules, 2021 (the “New TAT Rules”). You can download a copy here.

The rules guide the conduct of tax appeals at the Tax Appeal Tribunal, the court of first instance on issues between the Federal Inland Revenue Service and taxpayers within Nigeria. The New TAT Rules replace the 2010 TAT Rules.

Some of the key updates from the New TAT Rules include the introduction of electronic filing & service of processes and hearings. So, we can cite this as one of the good bargains of technology and Covid in our judicial system. You no longer have to physically go to the tax court to file processes. You can also serve court notices and processes via email. Cool! Asides that, the New TAT Rules introduce the Document Only Procedure, and the Summary Appeal Procedure, both of which would likely operate as a fast-track means of tax dispute settlement. Again, cool!

Here’s the catch.

Another significant provision made by the New TAT Rules is the required deposit of 50% of disputed tax assessment, as a precondition to tax appeal hearings. Recall Federal High Court has its own similar provision.

Order III Rule 6 of the TAT rules provides:

This “50% rule” makes compulsory, an optional directive under the FIRS Establishment Act which I referenced in our last update. That optional directive provides:

What the new 50% rule means:

Where FIRS charges Company A the sum of N500,000 as its tax liability to be paid in 2020. Company A’s CFO receives the tax notice and strongly feels they should be charged N100,000 instead as their 2020 tax liability. They send a response to the FIRS stating they will pay N100,000. FIRS sends a response to them saying, “No, you are to pay N500,000.” Company A appeals to the TAT to contest the N500,000 FIRS assessment. With this rule, Company A will have to first deposit N250,000 before their case can be heard.

The fallout:

What happens when Company A has to challenge another assessment of the FIRS at the Federal High Court? The Federal High Court also has a similar “50% rule” which requires deposits before it hears appeals from aggrieved taxpayers.

In the above scenario, Company A may have to deposit N250,000 again (totaling N500,000) at the FHC to have its matter heard. Essentially, it has paid two different tax panels - TAT & FHC, a total sum it probably cannot even afford in the first place. Interestingly, the two tax panels do not provide for the process of returning the deposit in their respective 2021 Rules (though I imagine, the deposit repayment will be part of the reliefs sought by Company A in their Motion Paper*).

That is the Catch 22 facing Company A and many other tax-paying entities in Nigeria. The provision and its needlessness, call for a deep soul-searching among regulators. Frankly, I do not see a justification for the rule.

In a scenario where Company A fails in its appeal process, and the FIRS succeeds, Company A cannot literally ‘run away’ from the country without paying those taxes and FIRS has exhaustive mechanisms to execute a judgment in their favor.

In another scenario where Company A’s appeal succeeds, the 50% deposit would have served no useful purpose, but sitting in a dormant account of the government - not being used for anything commercially rewarding.

While I’ve been made to understand that there is a kind of unwritten rule with regulators, that an ‘offending company’ may have to pay a section of a fine or assessment, to show good faith, standardizing such tradition to the extremes of 50% deposit, removes the utilitarian nature behind the unspoken rule.

Interestingly, Multichoice (the parent companies to DSTv and GOTv) has paid N8 Billion - far removed from the N900 Billion payable - into the FIRS account in its current appeal against the tax authority, before the Tax Appeal Tribunal. Read more about it here. The tribunal will make a ruling on this by October 20th, so I’ll keep you updated.

In contrast to how popular they are getting, it is hard to justify how needful the “50% rule” is in Nigeria’s tax appeal processes. I hope it soon becomes a constitutional issue and the provision is challenged on the grounds of a fair hearing.

The latest salvo in Nigerian Tax Wars 🎯

The Value Added Tax (VAT, a tax charged on almost all the things you buy from toothpaste to non-basic food items like Semo!) has been the front burner issue between the Federal Government and States in the past month.

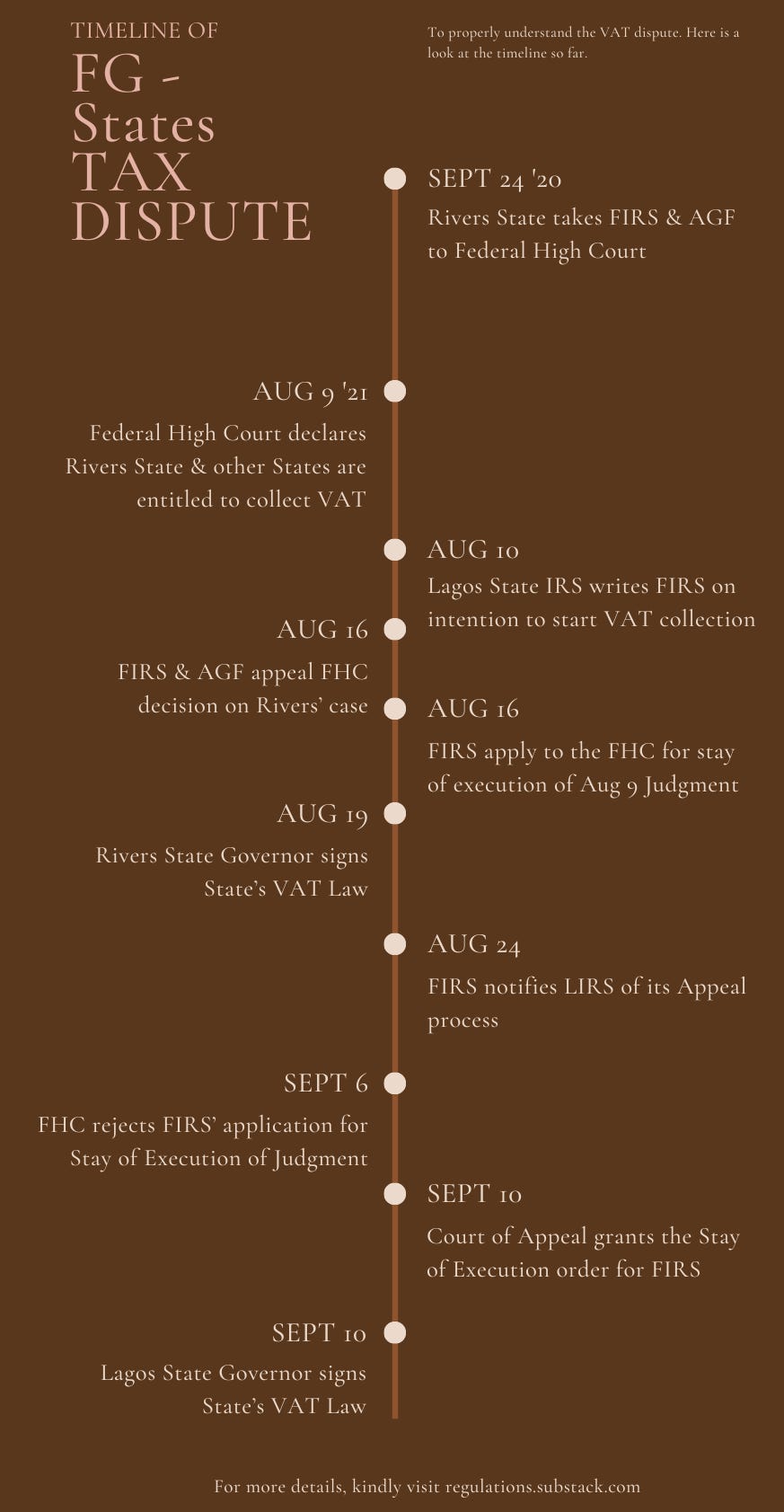

ICYMI, here is a quick look at what has been happening concerning the tax dispute, in the past month. 👇🏽

The update so far is that Rivers State has approached the Supreme Court on the ruling of the Court of Appeal. Everybody will certainly choose how to interpret the status quo decision of the Court of Appeal, in their interest.

In a public notice published yesterday, the Minister of Finance has riled against the confusing consequences of the litigations on the VAT issue. The notice cited the status quo ruling of the Court of Appeal and directs that all taxpayers continue to remit their taxes to FIRS and that FIRS continues to administer VAT in States until appellate courts rule otherwise.

Will this Ministry of Finance directive clear up the confusion in most VAT-generating states like Lagos and Rivers? I doubt it. These States have enacted new VAT laws, which were not really the subject of the case at the Federal High Court. And can a Court injunction be made suspending a law competently passed by a State House of Assembly? This would likely devolve into more constitutional issues, way beyond the VAT that the case emanated from.

Reportedly, the Federal Government is mulling taking the matter straight to the Supreme Court, as announced by the Attorney-General of the Federation. That has been a long time and hopefully, a quick resolution will be found to what has been a rather interesting highlight of Nigeria’s fiscal year.

That’s it for today. Have a great weekend!

* This was previously ‘Written Address’, however, I’ve been made to understand reliefs are sought in Motion Papers, instead.